We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

The prices of solar power plant have seen a huge downshift (Figure 1) due to various (positive and negative) reasons. Such downshift of prices has led to a round of curiosity among the investors on the profit margins from the system. With the advancement of technology it is now possible to have various alterations in a solar power plant.Such variations may alter the economics of the power plant which are governed by business models. While we explained various business models in our previous article, it is also important to understand their underlying indicators i.e. Levelized Cost of Electricity (LCOE), Return on Investment (ROI) and Specific energy yield. Before jumping on to those indicators, let us first understand how the solar power plant generates revenue.

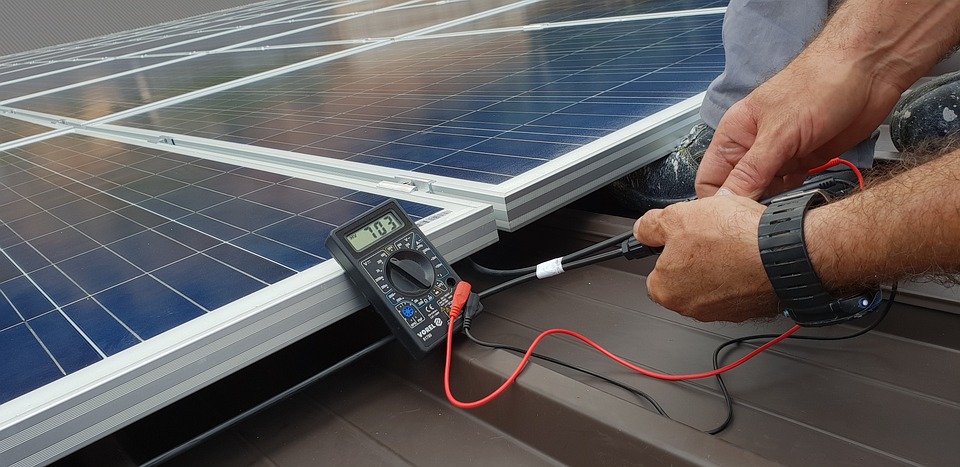

The solar power plant (as any other business) needs the most fundamental entity i.e. adequate investment. This investment can be arranged by the developer/owner or could be in form of loan from the funding agency. This investment is offset by the electricity the solar plant generates when light falls on it. This generated electricity is sold at per unit price (i.e. INR/kWh) which is the source of revenue for the developer/owner. It is important that such revenue matches the expectation of the business model for appropriate return. This article would inform its readers about the important indicators used to (indirectly) gauge the performance of solar power-plants.

1 : Recent trends of Utility scale solar energy price (Source: Mercom Capital Group)

The LCOE of solar power plant is one of the most commonly used indicators. But its meaning is not quite correctly understood. For a solar power plant (or for any power plant in general)LCOE may be defined as the power production cost over the plant’s lifetime. It is calculated by summing up the plant’s lifetime cost and dividing it by lifetime energy production from the plant.

Where,

Lifetime cost of solar project (in INR) = Project cost + Operation & Maintenance cost + Loan Payment (if any)&Lifetime energy production of solar plant (in kWh) = Total energy generated in 25 years

Measured in INR/kWh, LCOE allows us to compare different technology irrespective of their lifetime, project size, capital cost, risks and return. Such tool would enable a decision maker/ investor/developer/end consumer to assess and move ahead to invest in a particulartechnology. Comparing LCOE for various power plants can highlight the prospect to develop various technologies for different scales. It may also indicate the cost competitiveness of a project compared to utility cost over the lifetime of the plant. An example calculation of LCOE for solar plant (a standard 10 kWp power plant) is shown as below:

See Also: Largest Solar Energy/Power Plant in India [2023]

Table 1 : Calculation of LCOE for 10 kWp power plant

| Year | Total systemcost (INR) | O&M Cost (INR/year) | Cumulative cost(INR) | No. of units generated (kWh) |

| 1 | 6,90,000 | 0 | 6,90,000 | 18,000 |

| 2 | 6,90,000 | 0 | 6,90,000 | 17,865 |

| 3 | 6,90,000 | 0 | 6,90,000 | 17,731 |

| 4 | 6,90,000 | 0 | 6,90,000 | 17,598 |

| 5 | 6,90,000 | 0 | 6,90,000 | 17,466 |

| 6 | 6,90,000 | 6,900 | 6,96,900 | 17,335 |

| 7 | 6,90,000 | 6,900 | 7,03,800 | 17,205 |

| 8 | 6,90,000 | 6,900 | 7,10,700 | 17,076 |

| 9 | 6,90,000 | 6,900 | 7,17,600 | 16,948 |

| 10 | 6,90,000 | 6,900 | 7,24,500 | 16,821 |

| 11 | 6,90,000 | 6,900 | 7,31,400 | 16,695 |

| 12 | 6,90,000 | 6,900 | 7,38,300 | 16,569 |

| 13 | 6,90,000 | 6,900 | 7,45,200 | 16,445 |

| 14 | 6,90,000 | 6,900 | 7,52,100 | 16,322 |

| 15 | 6,90,000 | 6,900 | 7,59,000 | 16,199 |

| 16 | 6,90,000 | 6,900 | 7,65,900 | 16,078 |

| 17 | 6,90,000 | 6,900 | 7,72,800 | 15,957 |

| 18 | 6,90,000 | 6,900 | 7,79,700 | 15,838 |

| 19 | 6,90,000 | 6,900 | 7,86,600 | 15,719 |

| 20 | 6,90,000 | 6,900 | 7,93,500 | 15,601 |

| 21 | 6,90,000 | 6,900 | 8,00,400 | 15,484 |

| 22 | 6,90,000 | 6,900 | 8,07,300 | 15,368 |

| 23 | 6,90,000 | 6,900 | 8,14,200 | 15,253 |

| 24 | 6,90,000 | 6,900 | 8,21,100 | 15,138 |

| 25 | 6,90,000 | 6,900 | 8,28,000 | 15,025 |

| TOTAL COST = 8,28,000 INR TOTAL ENERGY GENERATED = 4,11,736 units LCOE = 8,28,000/4,11,736 = 2.01 INR/kWh |

||||

In solar power plant, LCOE is more important for utility scale power plant. This is because in huge power plant, LCOE can indicate what should be the selling price of the energy to break even at-least at the end of plant’s lifetime.

The ROI in very generic terms can be defined as a profit ratio in any business. It informs the investor whether the invested capital is generating appropriate profit or not. Indicated in percentage, it is calculated by dividing the net profit to the total cost of investment.

| ROI = | Net Profit | *100 |

| ————————– | ||

| Total cost of investment |

Where,

Net profit (in INR)= the profit realized after deducting taxation and interest(s)

Total cost of investment (in INR)= the net realized cost of investment for a particular project

As evident from above, the ROI takes into account the taxes and interest giving the investor/end consumer a realistic value. Additionally, it would also enable them to compare different technologies to understand their return. However, ROI does not take into account the technical considerations (which are important for solar power plant). A sample calculation to calculate ROI for solar plant (a standard 10 kWp power plant) is shown as below:

Table 2: Calculation of ROI for 10 kWp power plant

| Year | System cost | O&M cost | Total cost | Gross savings after tax and interest |

| 1 | 6,90,000 | 0 | 6,90,000 | 7,071 |

| 2 | 6,90,000 | 0 | 6,90,000 | 16,299 |

| 3 | 6,90,000 | 0 | 6,90,000 | 27,751 |

| 4 | 6,90,000 | 0 | 6,90,000 | 41,495 |

| 5 | 6,90,000 | 0 | 6,90,000 | 57,602 |

| 6 | 6,90,000 | 6,900 | 6,96,900 | 76,147 |

| 7 | 6,90,000 | 6,900 | 7,03,800 | 97,205 |

| 8 | 6,90,000 | 6,900 | 7,10,700 | 1,20,857 |

| 9 | 6,90,000 | 6,900 | 7,17,600 | 1,47,185 |

| 10 | 6,90,000 | 6,900 | 7,24,500 | 1,76,276 |

| 11 | 6,90,000 | 6,900 | 7,31,400 | 2,08,219 |

| 12 | 6,90,000 | 6,900 | 7,38,300 | 2,43,106 |

| 13 | 6,90,000 | 6,900 | 7,45,200 | 2,81,034 |

| 14 | 6,90,000 | 6,900 | 7,52,100 | 3,22,103 |

| 15 | 6,90,000 | 6,900 | 7,59,000 | 3,66,415 |

| 16 | 6,90,000 | 6,900 | 7,65,900 | 4,14,080 |

| 17 | 6,90,000 | 6,900 | 7,72,800 | 4,65,209 |

| 18 | 6,90,000 | 6,900 | 7,79,700 | 5,19,918 |

| 19 | 6,90,000 | 6,900 | 7,86,600 | 5,78,326 |

| 20 | 6,90,000 | 6,900 | 7,93,500 | 6,40,561 |

| 21 | 6,90,000 | 6,900 | 8,00,400 | 7,06,750 |

| 22 | 6,90,000 | 6,900 | 8,07,300 | 7,77,029 |

| 23 | 6,90,000 | 6,900 | 8,14,200 | 8,51,537 |

| 24 | 6,90,000 | 6,900 | 8,21,100 | 9,30,420 |

| 25 | 6,90,000 | 6,900 | 8,28,000 | 10,13,827 |

| TOTAL COST = 8,28,000 INR NET PROFIT = 10,13,827-8,28,000 = 1,85,827 INR ROI = 1,85,827/8,28,000 x 100 = 22.45% |

||||

While useful for both (utility and rooftop scale) power plant, ROI is of prime interest to a rooftop scale power plants who owns the plant. This is because such customer would be interested in understanding and realizing the return on their investment.

For a solar power plant where more than half of its investment cost is dependent on solar module, it is important that they (solar module) perform to their maximum. The performance of solar module can be estimated by the amount of energy (kWh) it produces over a specific period of time. However, due to different solar module design and efficiencies, it is easier to evaluate the performance (and hence their capability) of various solar modules by determining its specific energy yield (kWh/kWp) i.e. by dividing the Energy generated (kWh) to its power output PSTC (kWp).

Where,

Energy generated = the generated energy for specified period of time

Power output at STC = the standard rated power output of solar plant at STC

In the example mentioned above (Table 1), the specific energy yield of the plant would be 1800 kWh/kWpin the first year but would reduce continuously due to degradation in plant output. While the rooftop scale power plant owner may not completely understand the technicality of the plant, specific energy yield would be important to both utility and rooftop scale plants to understand it’s performance.

To finally conclude, the LCOE gives a clear picture of both commercial and technical aspects of power plant. ROI and specific energy yield on the other hand strictly focus on the commercial aspect and the technical aspect respectively. In order to completely asses the power plant, it is important to have a balance between both commercial and technical aspects making LCOE an important parameter. ROI and specific energy yield can be given due importance as and when required by the investor/developer/end consumer.

We at Waaree have a total EPC experience of more than 300 MW with more than 500 MW of solar modules installed globally. We have executed more than 4000 projects solarizing the remotest corners. We have assisted our customers on various crucial parameters to set up a power plant which would maximize their returns.

Let us all pledge to make solar energy the primary source of energy in the near future.

RAHE ROSHAN HAMARA NATION

Notifications