India is dynamic in terms of solar power sectors. It is in fifth place worldwide in power generation. The Indian solar loan program was launched in 2003 for the benefit of investors in solar power systems. Further, they provide CFA – Central financial Assistance schemes to promote the use of solar PV systems in India.

Utility-scale, commercial & industrial (C&I), residential, and off-grid segments exist in the Indian economy, as they do in other markets around the world.

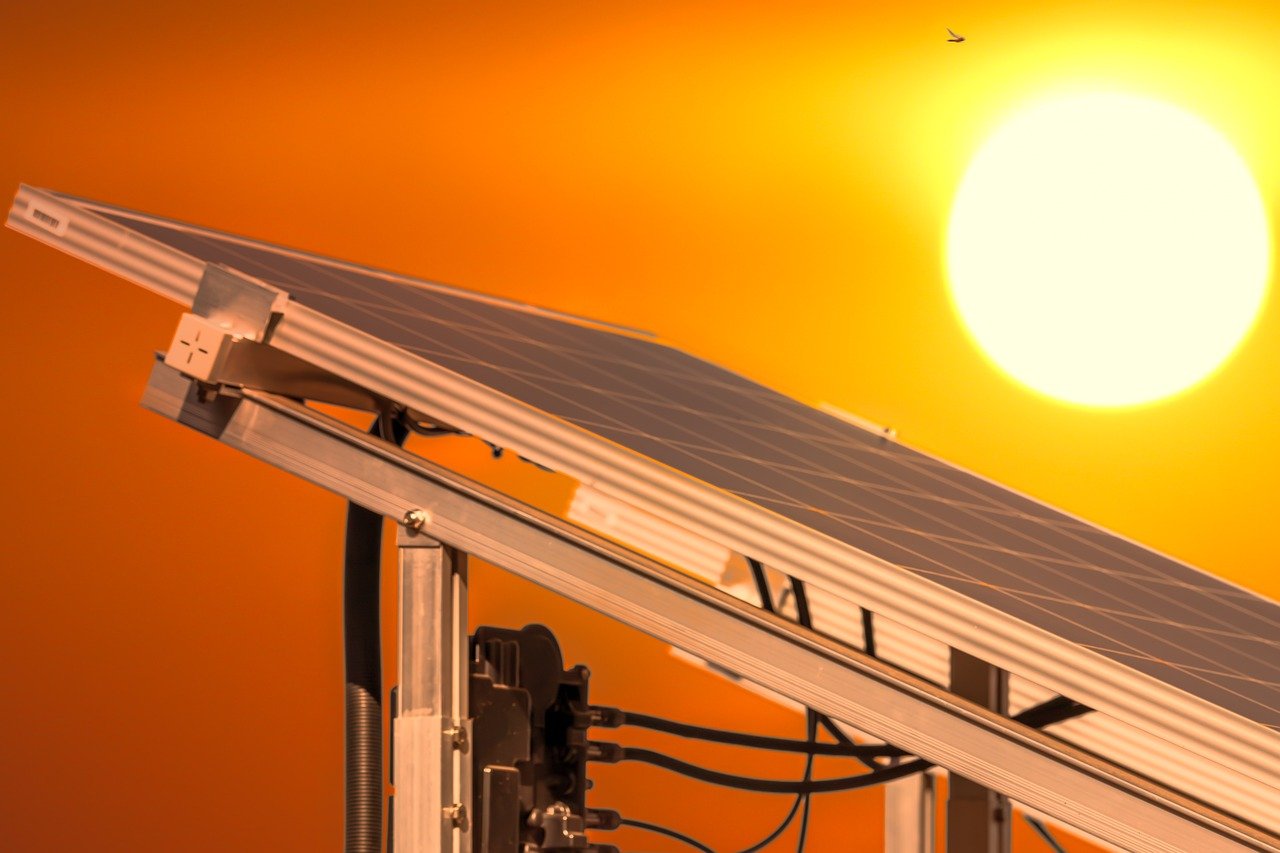

While the sun’s energy is free, constructing a MW level solar plant is costly. One of the most difficult challenges for MW solar plant investors is finding financing choices. It’s crucial to pick a solar financing option that works for your company. The average cost of constructing a plant is about 6 crores per megawatt.

Equity will cover 30% of the cost, while debt will cover the remainder. Equity is just a fancy term for trying to finance your solar finance project with your own money or other investors’ help. Debt funding is typically available with recourse, which means that the lender would be required to put up collateral as insurance for the loan they plan to take out.

It is very expensive to build a solar plant; you can still find subsidies and solar loans from the government or banks.

If the solar finance is obtained from outside sources, this is a possibility, particularly if the components used are also imported from the lending country. As a result, DCR (Domestic Content Requirement) projects are typically ineligible. Interest rates, including hedging, are expected to be 8-10% if the project is funded overseas. However, funding would only cover a portion of the project’s expense, which is usually the panels.

Over the past century, the natural world has changed dramatically. The changing scenario necessitates a greater level of attention and a more action-oriented policy structure to use renewable and sustainable resources. The Indian government has taken note of global trends and has implemented several green and environmentally sustainable policy initiatives as part of the National Action Plan on Climate Change.

Waaree is leading in terms of manufacturing solar panels and other systems related to solar power systems. Contact us for more information regarding rooftop installations, solar inverters, solar street lights, etc.