During the last decade, solar PV manufacturing capacity has increasingly moved to China from Europe, Japan and the United States. More than 300 000 manufacturing jobs have been created across the solar PV value chain since 2011, as China has invested over USD 50 billion in new PV supply capacity. Today, China dominates all stages of solar panel manufacturing (including polysilicon, ingots, wafers, cells and modules). China's share of global PV demand has more than doubled. Moreover, the country is home to 10 of the world's top solar PV equipment suppliers. Clean energy transitions have benefited greatly from China's ability to bring down solar PV costs worldwide. The level of geographical concentration in global supply chains also poses potential challenges that governments must address.

Let’s see what is the growth in a decade by countries to manufacture a PV module at its various stages.

As we can see from the above graphs that in just a decade’s time, China has conquered the market for every stage of PV module manufacturing, be it – Modules, Cells, Wafers or Polysilicon.

What might be the reason for the Chinese dominance of this market, the obvious answer would be ‘Cheaper cost’, ‘manufacturing capacity,’ etc. The below graph shows the 2022 total production costs for mono PERC c-Si solar components by country.

China's industrial policy, which focuses on solar power as a strategic sector and growing domestic demand, enables economies of scale and supports continuous innovation across the supply chain. These policies have contributed to cost reductions of over 80% and helped make solar power the most affordable power generation technology in many parts of the world. However, they also create an imbalance between demand and supply in the PV supply chain. Global capacity to manufacture the key solar PV elements, wafers, and cells, and assemble them into solar modules (also known as panels) will exceed demand by at least 100% by the end of 2021. In contrast, the production of polysilicon, a key material for photovoltaics, has become a bottleneck in an oversupplied supply chain. This tightened global supplies, driving the price of polysilicon to quadruple its price in the past year.

In 2021, China's solar PV exports will exceed US$30 billion, accounting for about 7% of China's trade surplus over the past five years. In addition, Chinese investments in Malaysia and Vietnam have made these countries major exporters of PV products, accounting for about 10% and 5% of the trade surplus respectively since 2017. Total global PV-related trade, including polysilicon, wafers, cells, and modules, will exceed $40 billion in 2021, up more than 70% from 2020.

Power-intensive photovoltaic manufacturing currently relies primarily on fossil fuels, but solar panels only need to be in operation for four to eight months to offset manufacturing emissions.

This payback period is comparable to the life expectancy of a solar panel of approximately 25-30 years. Electricity provides 80% of the total energy used in the production of photovoltaics, most of which is used in the production of polysilicon, ingots, and wafers that require heat at high temperatures and precise temperatures. Today, coal produces more than 60% of the electricity used in global photovoltaic production, significantly larger than its share of global electricity production (36%). This is mainly due to the concentration of photovoltaic products in China. It is mainly concentrated in Xinjiang and Jiangsu provinces, where coal accounts for more than 75% of the annual electricity supply and benefits from low government tariffs.

”The world is moving toward achieving NET ZERO, and in order to do that there lies a huge reliance on Solar power electricity.”

Demand for solar power for critical minerals will increase rapidly on the road to net zero emissions.

Production of many of the key minerals used in PV is highly concentrated, with China playing a dominant role. Despite improvements in the more efficient use of materials, the demand for minerals in the photovoltaic industry will increase significantly. For example, in the IEA's roadmap to net zero emissions by 2050, the demand for silver for solar power generation in 2030 will increase from around 10% today to 30% of total global silver production in 2020. % can be exceeded. This rapid growth, coupled with long lead times for mining projects, increases the risk of supply and demand mismatches, which can lead to rising costs and supply shortages.

The long-term financial sustainability of the photovoltaic manufacturing sector is critical to a rapid and cost-effective transition to clean energy.

Net profitability of the solar power sector across all segments of the supply chain has been volatile, leading to several bankruptcies despite political support. The risk of bankruptcy and poor profitability could slow the pace of the transition to clean energy if companies are hesitant to invest due to low returns or are unable to withstand rapid changes in market conditions.

There is a risk that trade restrictions will be tightened and the introduction of solar power will be delayed.

Supply chains are vulnerable to trade policy risks as trade is essential to provide the various materials needed to manufacture solar panels and deliver them to the end market. Since 2011, the number of anti-dumping, countervailing, and import duties imposed on parts of the PV supply chain has increased from 1 import duty to 16 tariffs and import duties, with 8 other measures under consideration. I'm here. Collectively, these measures cover 15% of global demand outside China.

Low-cost electricity is the key to competitiveness for a major pillar of the photovoltaic supply chain. Diversification of high-concentration polysilicon, ingot, and wafer manufacturing offers the advantage of stable supply. Electricity accounts for more than 40% of his polysilicon manufacturing costs, nearly 20% for ingots and wafers. About 80% of the electricity for polysilicon production is currently consumed in rural China, with an average electricity price of about US$75 per megawatt-hour (MWh). This is almost 30% below the global industry average price. To remain competitive in these segments, manufacturers must have access to comparable or lower power costs.

Building solar manufacturing around low-carbon industrial clusters can unlock the benefits of economies of scale. Solar panel manufacturers can also use their products to generate their own renewable power on-site, reducing both electricity bills and emissions. Power-intensive PV systems can be located near emerging industrial clusters (such as hydrogen-based renewables) and benefit from low-cost renewable power. On the other hand, economies of scale and vertical integration in manufacturing can reduce variable costs and further increase competitiveness.

Recycling PV modules offer environmental, social and economic benefits and increase long-term supply security. According to the IEA, if modules were systematically retired at the end of their life, the PV industry would meet over 20% demand for aluminium, copper, glass and silicon between 2040 and 2050, and 70% for silver. However, existing PV recycling processes struggle to generate sufficient revenue from recovered materials to cover the costs of the recycling process.

Manufacturing PV modules in India is not a new industry. Waaree Energies is India’s largest PV module manufacturing company and is been operational since 2007, backed by its experience in instrumentation earlier.

Indian government this year has taken enormous steps in order to boost domestic manufacturing of PV modules such as

In Phase I:

From 15% import duty on PV modules in April 2022 the BCD increased to 40% on PV modules and 20% on PV cell imports.

The import duty on Inverters has also increased from 5% to 20% in order to boost domestic manufacturing and motivate the SPDs (Solar Power Developers) to go for domestic available options.

Government has also mandated that the PV rooftop plants have to use domestic PV modules in order to claim subsidies or tax rebates.

In phase II:

Any new company that aims to set up its manufacturing setups in India faces the following problems:

Machinery

Land

Labour

Construction

Due to the high Entry barrier risk involved, most companies are hesitant to invest.

GOI has launched a PLI (Production linked incentive) scheme in order to boost domestic manufacturing capacity for PV cells and modules by

Nullifying the import duties on machinery

Giving 30% tax rebates on land acquisition in SEZ

Tax Exemption for 1st-year operations.

It does sound that GOI is exorbitantly giving a lot of incentives without earning much but below are some returns that GOI seeks in long run:

Recurring taxes (GST) on selling PV plant components

Increasing employability of white-collar employees who again end up paying income tax.

Reducing dependency on fossil fuels and leading the country towards Energy Independence.

Read Further: Top 10 Solar Companies in India [2023]

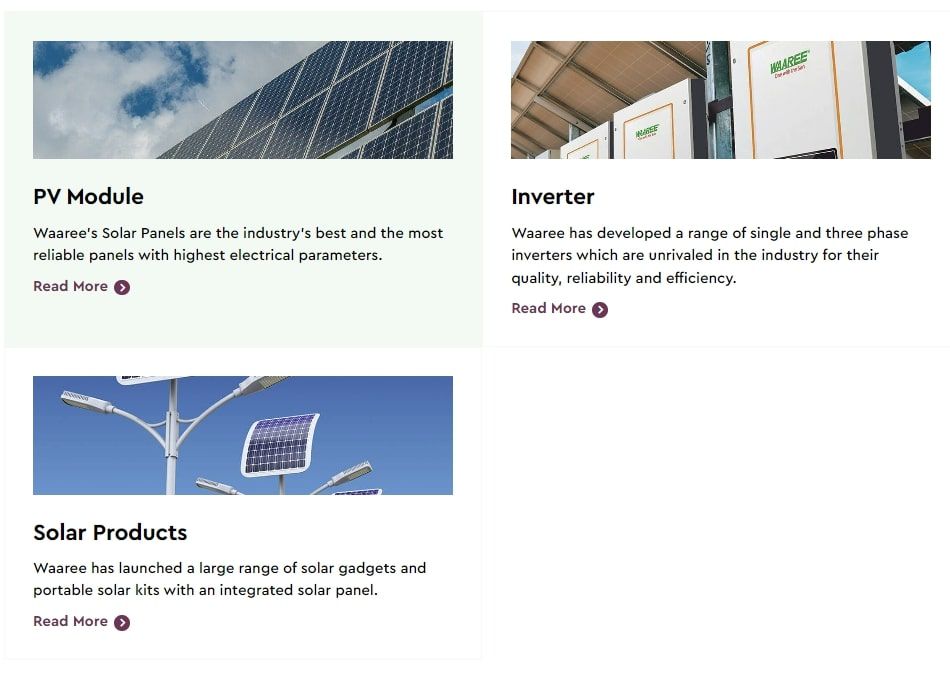

PRODUCTS OFFERED

Waaree Energies Ltd. is the flagship company of Waaree Group, founded in 1989 with headquarters in Mumbai, India. It has India's largest Solar panel manufacturing capacity of 5GWs at its plants in Surat and Umbergaon in Gujarat. Waaree Energies is amongst the top players in India in Solar Panel Manufacturing, EPC Services, Project Development, Rooftop Solutions, and Solar Water Pumps and is also an Independent Power Producer. Waaree has its presence in over 380 locations nationally and 20 countries internationally. Step on to your cleaner journey by contacting us at 18002121321 or mail us at waaree@waaree.com