For an average Indian, the government of India does provide the subsidy. However, even with this, it can be difficult to get the capital. This article focuses on the solar loans you can avail which will help you finance your solar panel. But before we discuss that, let us understand solar subsidy.

Both the central and state governments provide solar subsidy schemes. This is a type of ‘discount’ for installing and maintaining your solar panel. The central government provides a 30% solar subsidy for the general public.

For households in Uttarakhand, Sikkim, Himachal Pradesh, Jammu and Kashmir, and Lakshadweep, the central government provides a 70% subsidy for rooftop solar panels. This is an incentive for households to install solar panels.

However, there is one additional eligibility criteria. To avail of this subsidy, your household should invest at least INR 60,000 in installing the solar panel.

So, how do you get the start-up capital of INR 60,000 for solar panel installation?

There is no direct solar loan available that you can apply for. Banks and NBFCs have yet to introduce such a category. However, you have other financial options.

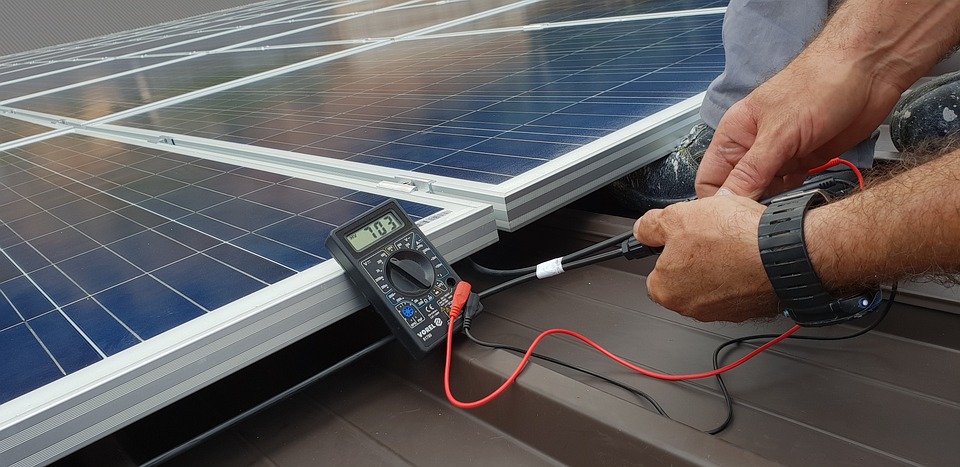

You can apply for a home loan or a home renovation loan at any bank. These can easily cover the installation and purchasing costs of solar panels. You can also ask your bank whether they would provide a loan for solar panel installation. However, these will have different rates of interest and tenure period.

Additionally, your loan eligibility will further determine the rate of interest you receive. Banks and NBFCs generally consider your credit score and financial history before approving your loan.

It is possible to buy a solar panel using your debit and credit card. Several banks, including ICICI, Kotak, HDFC provide loan facilities on their credit and debit cards. Several solar companies also have tie-ups with banks that will help you avail of solar loans. For example, Luminous has a tie-up with IDBI bank that can help you finance your solar panel costs and installation.

Currently, EMIs and Home loans are the only two financing options available in India. As the general public becomes more aware of the advantages of solar panels, more financial options will begin to crop up.

While many people may be disheartened by the lack of financial options and may be reluctant to get a solar loan, it is important to note that there are several advantages to installing a solar panel. The solar subsidy provided by the government is one of the major benefits. Once you’ve installed an appropriate solar panel, you may be eligible to get the subsidy. Therefore, before deciding not to install a solar panel, do a thorough research of your financial options by visiting the banks and NBFCs near you.

Luckily for everyone some of Waaree’s franchisee can help you with the subsidy or loan. Also, Waaree Energies Ltd is the best bet for getting solar products for your homes or businesses.

You can also read: Is it true that the life of Solar Panel is 25 years?